Some Ideas on Mileagewise - Reconstructing Mileage Logs You Should Know

Some Ideas on Mileagewise - Reconstructing Mileage Logs You Should Know

Blog Article

The 10-Second Trick For Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe 20-Second Trick For Mileagewise - Reconstructing Mileage LogsThe Mileagewise - Reconstructing Mileage Logs DiariesGetting My Mileagewise - Reconstructing Mileage Logs To WorkThe Best Strategy To Use For Mileagewise - Reconstructing Mileage LogsNot known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs Little Known Facts About Mileagewise - Reconstructing Mileage Logs.Some Known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance feature suggests the quickest driving path to your workers' location. This attribute boosts productivity and contributes to cost savings, making it a necessary property for organizations with a mobile labor force.Such a strategy to reporting and conformity simplifies the frequently complex task of managing gas mileage expenditures. There are several advantages connected with making use of Timeero to keep an eye on mileage. Allow's take an appearance at a few of the application's most notable functions. With a trusted mileage monitoring tool, like Timeero there is no demand to stress concerning unintentionally omitting a day or item of information on timesheets when tax obligation time comes.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

These added verification steps will certainly maintain the Internal revenue service from having a reason to object your gas mileage records. With exact mileage tracking innovation, your workers do not have to make rough gas mileage estimates or even worry about mileage expense monitoring.

If an employee drove 20,000 miles and 10,000 miles are business-related, you can compose off 50% of all auto expenditures (simple mileage log). You will need to proceed tracking gas mileage for job even if you're utilizing the actual expense approach. Keeping mileage records is the only way to separate business and individual miles and give the proof to the internal revenue service

A lot of mileage trackers allow you log your journeys manually while computing the range and compensation amounts for you. Lots of likewise included real-time journey monitoring - you require to start the app at the beginning of your journey and quit it when you reach your last location. These applications log your start and end addresses, and time stamps, along with the total range and repayment quantity.

8 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

This consists of costs such as gas, maintenance, insurance policy, and the vehicle's depreciation. For these expenses to be taken into consideration insurance deductible, the lorry this post should be used for company functions.

Mileagewise - Reconstructing Mileage Logs - An Overview

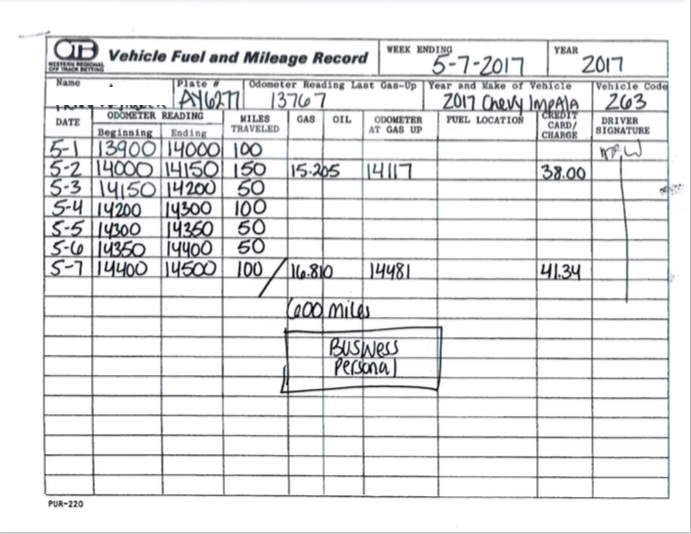

In between, diligently track all your organization trips keeping in mind down the starting and finishing readings. For each journey, record the location and service purpose.

This consists of the total service gas mileage and overall gas mileage accumulation for the year (service + individual), trip's date, location, and purpose. It's important to record tasks immediately and maintain a coexisting driving log describing day, miles driven, and service objective. Here's exactly how you can boost record-keeping for audit purposes: Start with making certain a precise mileage log for all business-related traveling.

Top Guidelines Of Mileagewise - Reconstructing Mileage Logs

The real expenditures approach is a different to the conventional mileage rate method. Rather than calculating your deduction based on an established rate per mile, the actual costs technique allows you to deduct the real prices connected with using your vehicle for company purposes - simple mileage log. These prices include fuel, maintenance, repair services, insurance, depreciation, and other related expenses

Those with considerable vehicle-related expenditures or one-of-a-kind problems might benefit from the actual expenditures method. Eventually, your picked method must straighten with your particular monetary objectives and tax situation.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

(https://linktr.ee/tessfagan90mi1eagewise)Calculate your overall company miles by utilizing your start and end odometer readings, and your videotaped company miles. Properly tracking your exact mileage for service journeys aids in corroborating your tax reduction, particularly if you decide for the Criterion Gas mileage method.

Maintaining track of your mileage manually can call for diligence, however keep in mind, it could conserve you cash on your taxes. Tape-record the complete mileage driven.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

And now virtually every person makes use of General practitioners to obtain around. That means virtually every person can be tracked as they go regarding their organization.

Report this page